Get Started Now!

How it works

Learn how the Advice-Only™ Standards of Practice govern transparent financial planning — and work with an independent advisor who follows them. Our AdviceOnly™ methodology ensures an objective and consistent planning experience.

All listed advisors practice under the Advice-Only™ Standards of Practice, which require structural separation between advice and implementation. Advice-Only™ Standards of Practice and defined by the Engagement Completion Boundary.

Our Services

FAQs

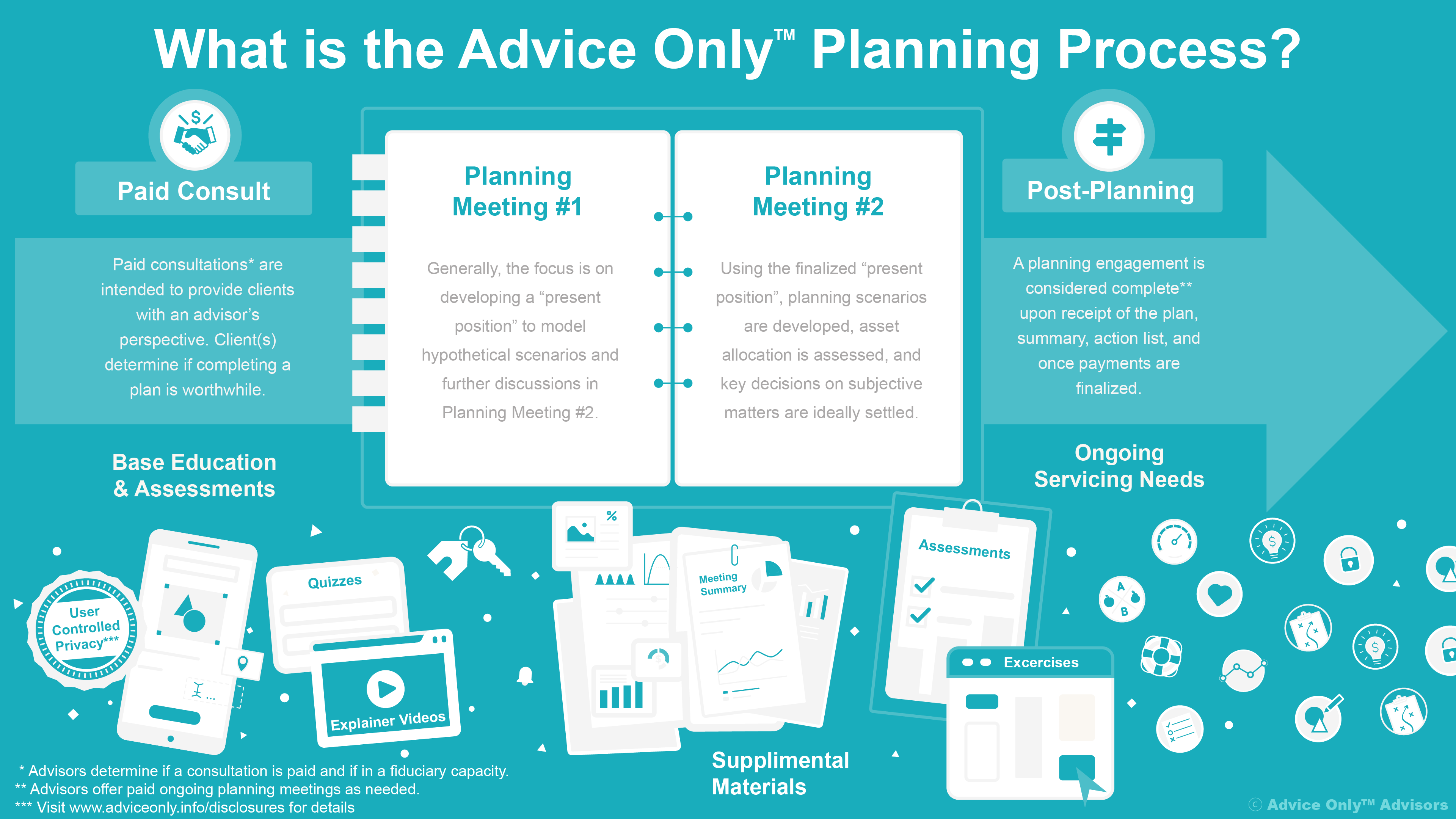

What is the Advice Only™ financial planning process?

Our financial planning process is a four-step fiduciary framework that separates advice from sales. By removing all implementation compensation—such as AUM fees, commissions, or product incentives—we ensure your plan remains objective and aligned with your goals.

Paid consultations provide clients with an advisor’s perspective. You decide whether completing a full plan is worthwhile.

We build your current “present position” and collect the inputs we’ll use to model scenarios and guide the next meeting.

We develop planning scenarios, assess asset allocation, and settle critical decisions on subjective matters.

The engagement ends when you receive the written plan, summary, and action list, and payment is finalized.

After an Advice-Only™ engagement is complete, you may independently choose to implement recommendations with any advisor, custodian, or company you select.

Any services an advisor may offer outside that completed engagement are governed separately and are not part of the Advice-Only™ planning process.

What’s the cost?

Costs are transparent and set by each independent registered advisor.

Educational materials may be free or paid depending on the course, and all planning and consultation fees are published in advance.

How do you respect my privacy?

We believe privacy is a part of our fiduciary duty. As such:

- We DO NOT sell or share client information.

- Information is only disclosed when you direct us or when legally required.

- Our firm does not participate in affiliate programs or accept referral benefits.

- All records are stored securely

Will my instructor be my advisor?

That’s 100% up to you.

Our instructors are practicing financial advisors who may also offer Advice-Only™ planning services. Many clients choose to work with the same instructor for continuity, but you are never required to do so.

After completing any educational program, you are free to engage any qualified Advice-Only™ advisor you choose.

Have a question or comment?

Please visit the Contact page if you have questions, comments, suggestions, or concerns. If appropriate, we’ll do our best to respond within 72 hours.