Home » FAQs

There are two core services when using the Advice Only™ process:

1) Buy a course. Our courses are written by practicing financial advisors. Each course is individually priced and includes quizzes, assessments, videos, and exercises. Course topics are designed to complement a student’s lifestyle, stage of life, and financial interests.

To get started, download via the Apple and Google Play stores.

2) Find an advisor instructor. Each Advice OnlyTM advisor sets their own pricing for courses, standalone financial plans, and paid consultations. To connect with an advisor, visit our app’s “Find an Advisor” tab. Here, you can browse our network of advisor instructors, view their profiles, and clearly understand how they work. It’s a straightforward process that puts users in complete control of finding the right advisor for their needs.

To get started, download via the Apple and Google Play stores.

The Advice OnlyTM process features a Singular Service Model. Advisors offering the Advice OnlyTM process are required to ensure objectivity throughout the totality of the base educational and formal planning engagement.

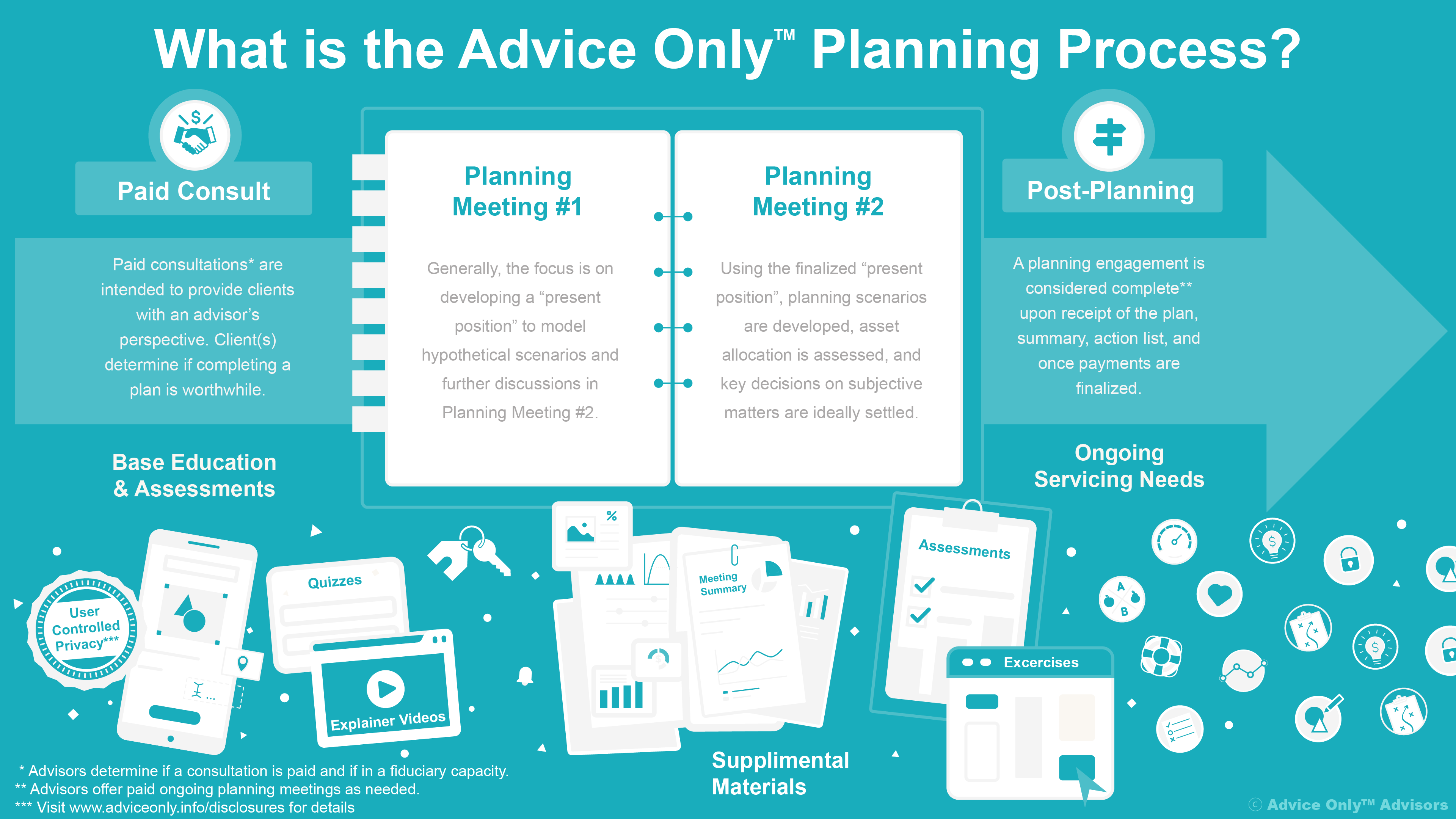

Paid Consultation: Paid consultations provide clients with an advisor’s perspective. Client(s) determine if completing a plan is worthwhile.

Planning Meeting #1: Generally, the focus is on developing a “present position” to model hypothetical scenarios and further discussions in Planning Meeting #2.

Planning Meeting #2: Using the finalized “present position,” planning scenarios are developed, asset allocation is assessed, and critical decisions on subjective matters are ideally settled.

Post-Planning: A planning engagement is considered complete upon receipt of the plan, summary, action list, and once payments are finalized.

Upon the conclusion of an Advice OnlyTM engagement, clients may, of course, implement services they independently deem necessary and appropriate through any advisor or company they choose.

Even though advisors on our platform may offer other services aside from the Advice OnlyTM planning process, our advisors have undergone training to maintain an objective environment until a plan is considered complete by a client—and that client has what they paid for.

The Advice OnlyTM methodology is ultimately a client request. After ten years of teaching courses at local colleges, crafting and exhibiting financial plans to the public, we listened to what our clients wanted and created a reliable process to deliver objective, standalone financial advice to the general public.

The Advice OnlyTM methodology is a unique financial planning process that ensures an objective planning experience throughout the entirety of the planning engagement. It is specifically designed to exclude the discussion of and reliance upon the expectation of new financial implementation, including product and investment management. This distinct approach sets it apart from other planning methodologies, offering clients a different and valuable perspective on their financial planning needs.

The Advice OnlyTM methodology rejects the “qualification” of clients by advisors to identify and promote preferred services wholly based on asset size or other personal data.

We describe our methodology as a process designed to ensure the delivery of objective stand-alone financial advice that ANY advisor can use and ALL clients can rely on.

Your servicing advisor welcomes consultations to discuss your financial needs and questions. While there’s no strict limit on the number of consultations, it’s important to understand that these are broad, informal meetings intended to provide an overview of your financial goals and explore whether a comprehensive financial planning engagement would be beneficial. They are not a substitute for full planning sessions.

Our policy is that clients can utilize the time allotted in whatever manner they choose. Ultimately, the advisor determines if a consultation is offered.

Talk with your advisor to better understand their policy with multiple consultations and the planning differences between a consultation and a formal planning meeting. If you have questions or a comment about your experience, please contact us.

Before the Advice OnlyTM methodology, other financial planning methodologies “built in” a default option for (and the advisor’s general expectation of) new financial implementation as part of a financial planning engagement process. Under these other methodologies, the advisor would typically recommend and expect the client to implement new financial products or solicit financial services as part of the planning process. Advisor compensation was and is almost exclusively managed investment accounts and product sales.

However, we found that when planning starts, clients are generally unaware of what new, if anything, should be implemented. We disagree with the premise of pre-determining ANY implementation outcome, whatever it may be, prior to gathering data, developing a plan, and making specific planning recommendations.

So, we took the initiative to create a methodology and process specifically for delivering objective advice that, by default and by design, separates implementation services from the whole of the planning engagement.

The Advice OnlyTM methodology promotes clarity, confidence, and peace of mind when making life’s most consequential financial decisions. We believe financial sales can have a place in financial planning, generally after a strategy can be developed, with whomever the client chooses, if at all, and only after formalizing planning engagements.

Of course, clients may consider implementation options with any professional they choose. However, when going through the Advice OnlyTM process, solicitations may only occur after the client has deemed a financial plan satisfactory and complete. Our methodology states that solicitor meetings (including referrals) must be conducted by an advisor wholly apart from the Advice OnlyTM planning process. An Advice Only™ advisor can never offer Advice OnlyTM services AND, at the same time, implementation services. Still, at a client’s independent request, an advisor may provide implementation services once a plan is considered complete by a client as long as there have been no prior implementation expectations or suggestions.

We consider a solicitation to include monetary and non-monetary forms of compensation, such as if the advisor receives or gives referrals or “favors” of Advice OnlyTM clients to or from other professionals or businesses that offer separate services, whatever those services may be.

We generally consider course sales final upon purchase. This policy keeps course prices affordable and adequately compensates advisors. If you’d like to evaluate course content before purchasing, please visit the individual course syllabus.

In rare cases, we may offer a refund at our discretion or the discretion of the applicable app store. To petition for a refund, please submit a request via our Contact Us page, clearly indicate your rationale for a refund, and include any reference materials (such as a screen grab).

We properly cite, acknowledge, compensate, and, when appropriate, contact and request permission from the artists, photographers, authors, and data providers used in our courses.

If we have made a mistake or you have a suggestion or concern, please contact us so we can evaluate and, if appropriate, remove or change a reference to ensure accuracy and due credit.

Made with 🤍 by AdviceOnly.info