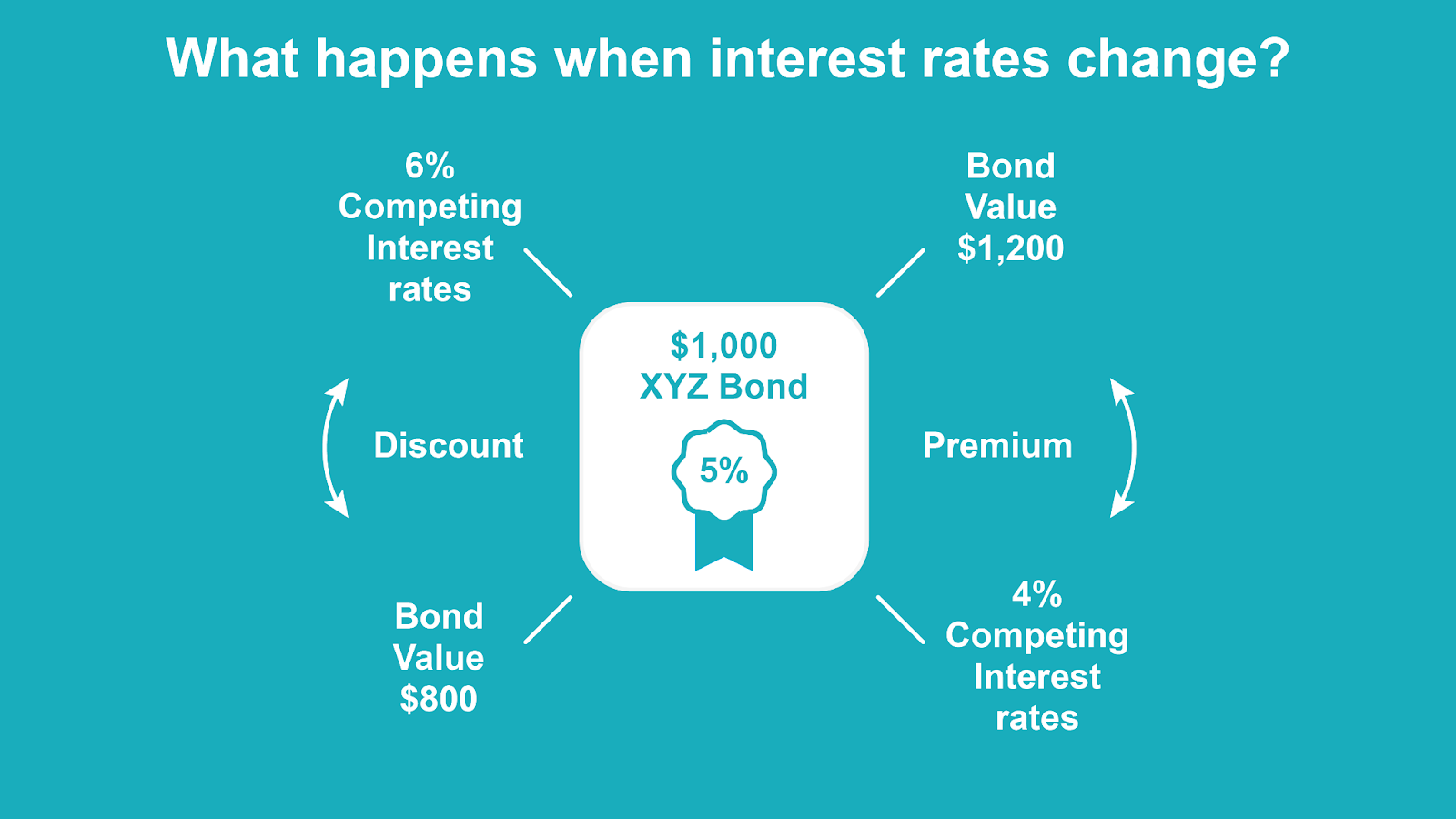

Raising rates in 2020 likely helped curb inflation.The Federal Reserve uses interest rates as a critical tool to manage inflation. Raising rates cools the economy by making borrowing more expensive, which can curb rising prices.

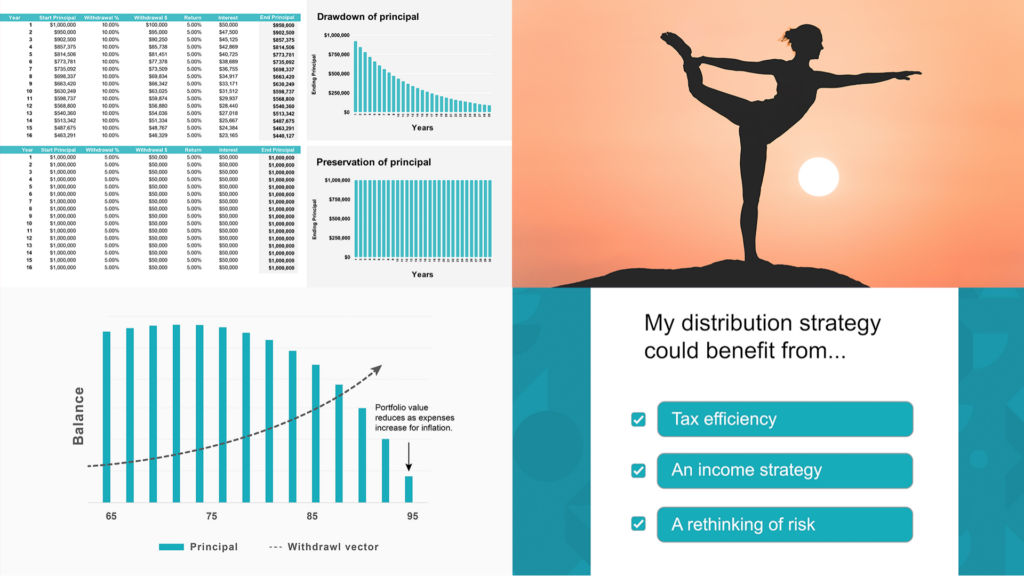

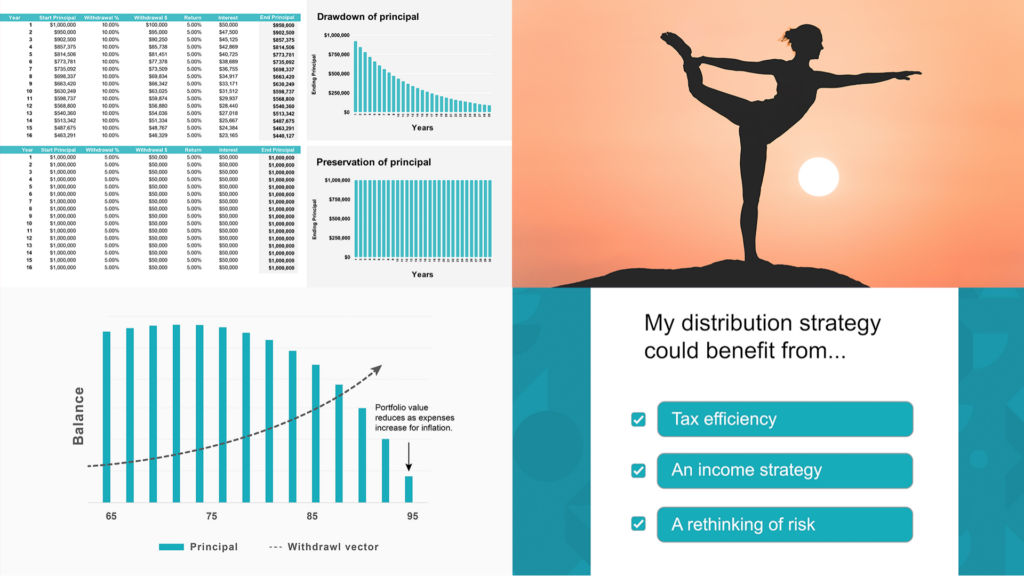

Particularly for retirees, cash flow and net worth statements are the primary documents for evaluating a financial plan’s overall health and long-term sustainability. These documents show how future income, expenses, taxes, and total portfolio assets interact to create a transparent “vector” to achieving retirement goals.

Particularly for retirees, cash flow and net worth statements are the primary documents for evaluating a financial plan’s overall health and long-term sustainability. These documents show how future income, expenses, taxes, and total portfolio assets interact to create a transparent “vector” to achieving retirement goals.

Retirees need a reasonable yield on "safe money." And borrowers need access to reasonably priced capital.

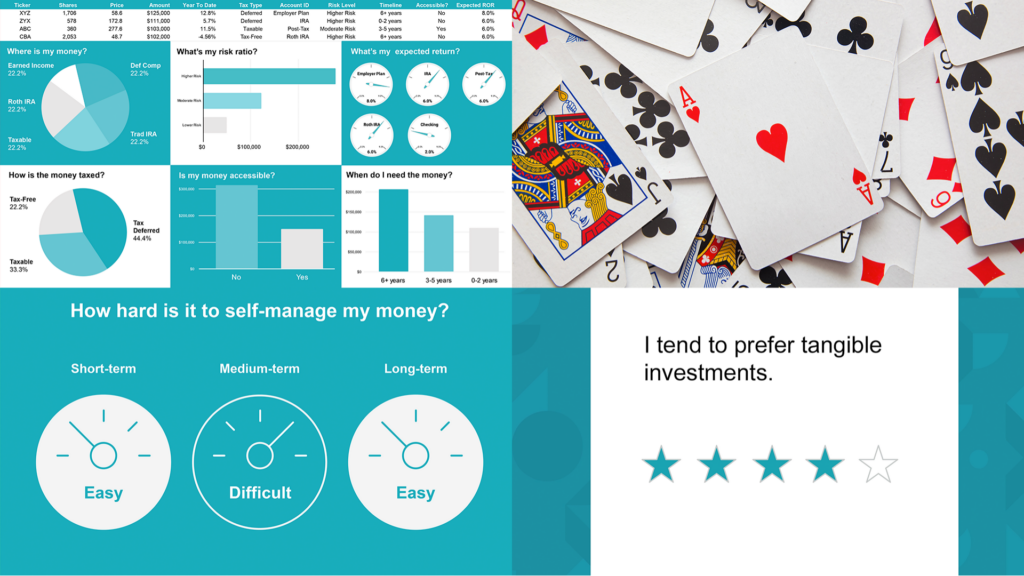

Top considerations include:

Made with 🤍 by AdviceOnly.info