Financial planning is becoming much more about you, the client. For the first time in history, the landscape for objective financial guidance is finally taking shape, offering greater control and personalized sound decision-making without prequalification, pre-judgment, or favoritism. I encourage clients to think selfishly. It’s your job. Our job as planners is to make your job easier and the process more enjoyable. It is a truly exciting time for the profession.

What’s financial stamina?

The most productive clients maintain a motivated attitude to improve their financial future. This enthusiasm dramatically increases both the client and advisor experience and translates to efficiency and better, more informed decision-making. Get-togethers are typically just a series of short 1.5 hr windows of attention. Feed on motivation while you can, and maximize the time while you have it.

Every penny counts.

Having a rational process

Having a rational process allows one to internalize planning subjectivity and view the totality of the financial planning landscape prior to deciding what, or if, to implement anything new. This is essential because consequential financial decisions shouldn’t be made in a “fog” but instead using a methodical well-rationed decision-making process. If not, then these decisions will inevitably be left in doubt. Even one shred of doubt is bad for the client and advisor experience.

Life is not math

Clients benefit greatly from understanding financial concepts in context and through guidance. Garnering essential clarity is required to make sound personal financial decisions. It still amazes me after ten years how so much of what we do as planners is highly qualitative.

Contrary to traditional planning, the individual is the best to parse through the subjective. This means having all the information and making a sound personal judgment. It’s often not the advisor simply telling a client what to do. Our job nowadays is to help provide a sound foundation, helping to work through the nuance, maintain focus and momentum on critical decisions, and understand preferences. Having a set process for effective and objective decision-making is a high-value proposition.

It’s your money, so it’s your decision.

It’s not impossible to understand

Financial planning is usually less complicated than it appears. It should be no secret that financial services make A LOT of money by keeping people overwhelmed and inefficient. I call it the “overlord” mentality. There is simply a vested interest in complexity and misunderstanding. I’m not just talking about investment management; I’m talking about every aspect of the financial planning landscape.

Don’t get me wrong; some aspects of financial planning are complicated. And some cases require highly intricate attention to detail. Still, others are teeming with efficiency, coordination, stress testing, and modeling. And they are also not solely limited to the super-wealthy. Those with fewer means are some of the most challenging yet amazingly impactful cases. A good advisor lives for those cases because it makes them better.

Go with the flow

While every case is a masterpiece to the client, not every case is the most complex requiring every quiver in our cap. The plan-building experience is an amazingly transferable skill set. The more an advisor plans, the more we make it look easy. I find that much of the intimidation clients have is simply “not knowing” or, probably more commonly – a fear of “not knowing.” That’s pretty easy to fix.

The range of personal mosaics and financial planning landscapes is as diverse as the individual. Without fail, people with the same financial profiles will have vastly different preferences and, as such, distinctly different financial plans. Our job as advisors is to keep you from making bad decisions and realistically give you reasonably and sustainably what you want. It’s your masterpiece.

The point is that planning should not be an exercise in frustration but a wonderful positive experience that all interested parties can participate in, no matter their knowledge. When appropriately done, the experience is not intimidating, and complex concepts are learnable. Advisors are moving from being “overlords” to educators – which is good for the consuming public. Technology now allows us to provide a core knowledge base to build the planning working relationship efficiently.

An objective experience

In most cases, financial plans design themselves. Experience and education teach an advisor what the proper framework should be. The client borrows from their advisor and builds on their own knowledge base. These intricacies help the “perfect” plan take shape.

Clients have done precisely one plan in their life – their own. What makes 1-1 personalized attention so valuable is the ability of the advisor to help a client visualize and develop their version of the “perfect plan.” The advisor’s value is the experience of doing lots and lots of plans, seeing how they play out for others, and bringing those experiences to the discussion—guiding the plan but allowing the client to fully comprehend detail and recognize opportunity making it truly their own creation.

You don’t need to be ” good with numbers.” Our job is to build the foundation. It’s the client’s job to understand the intricacies and decide on all the fun, personalized, subjective pieces.

No one should care more about your money than you.

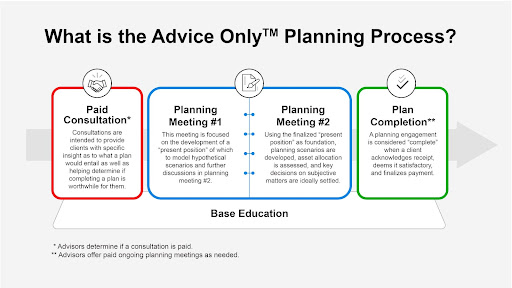

Clients often want to pay for an advisor experience out of pocket. That’s why the Advice-OnlyTM process is not limited to brand-new advisors. It is common knowledge that standalone planning has historically been something advisors “graduated from.” The Advice-OnlyTM methodology was designed so ANY advisor can use it, and ALL clients can rely upon a consistent, objective, conflict-free planning experience from start to finish. Seasoned and new advisors now have a defined process for delivering objective advice.

The future is today

Gone are the days when an individual could supplement needed retirement expenses with just a pension and social security. Despite the clear need, financial planning has been slow to keep pace with the planning requirements of the broader public. Planning remains uncoordinated and primarily centralized around products or managed investment accounts. Far too many need access to objective resources and a clear and cohesive strategy.

Furthermore, robust planning has only historically been offered as a service to those usually with assets. As such, clients are expected to implement products or asset management services. The fact is that implementation solutions are not always ideal or even appropriate. Sometimes it makes sense not to implement anything. To make matters worse, since advisor pay is directly connected to implementation by default and in practice, the focus is chiefly on those individuals with substantial assets or who have their money accessible to manage. Not to mention “qualification,” or the financial services industry’s technique for determining an individual’s assets before offering certain services.

There needed to be a defined process for the delivery of objective financial advice available to the masses, without the requirement or expectation of implementation, without “qualification,” and that ANY advisor could use and ALL clients could rely on.

We offer the objective truth

The objective truth is clarity and the ultimate peace of mind about what will happen to an individual financially. With this, individuals have an uncanny ability to achieve the impossible when they know what needs to happen and believe that the advice they receive is truly in their best interest without a shred of doubt. You want that when making certain consequential financial decisions.

Editor’s note: This blog offers informal investment and financial planning advice. We know nothing about your unique financial situation. The buying and selling of any financial product or security should only be considered in context. If appropriate, seek the counsel of experienced, ideally objective, financial, tax, or estate planning professionals. Past performance is not indicative of future performance.