California, the ‘Golden State,’ offers unique opportunities and challenges, especially for those entering their retirement years. To navigate these effectively and make informed financial decisions, financial planning for retiring Californians is crucial. Understanding the characteristics of the Golden State’s laws, from property taxes to in-home care options, can empower retirees to secure their future. This guide explores essential planning topics for California’s retirees, including:

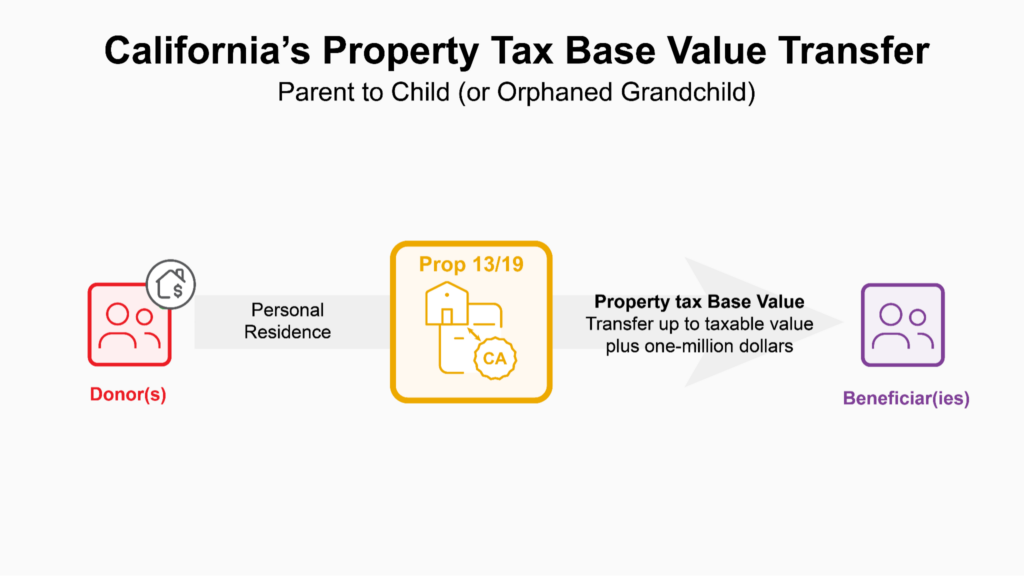

For those meeting these specified eligibility requirements, homeowners may transfer an existing property’s “base value” or California’s property tax factor on the original property’s assessment value. This factor is transferred and, moving forward, associated with a new property located anywhere in California. The law permits residents to do this up to three times in their lifetime.

“Qualifying” with Prop 19 involves separate planning considerations from Prop 13. While Prop 19 does act to limit the effectiveness of Prop 13 with certain taxpayers, much of Prop 19’s language benefits homeowners 55+, people with disabilities, and those affected by wildfires and other disasters. Its planning effectiveness is intended for those who qualify and are considering where to “live out” retirement years.

The state is aware of the challenges retirees can face getting in-home care services and the sometimes limited choices among medical and non-medical services.

The state’s Master Plan for Aging is working hard to integrate services and make them more accessible to people at home and in the community. According to the plan, “coordinated care” between health plans and community organizations serving older adults and people with disabilities has improved lifelong health outcomes and overall satisfaction.

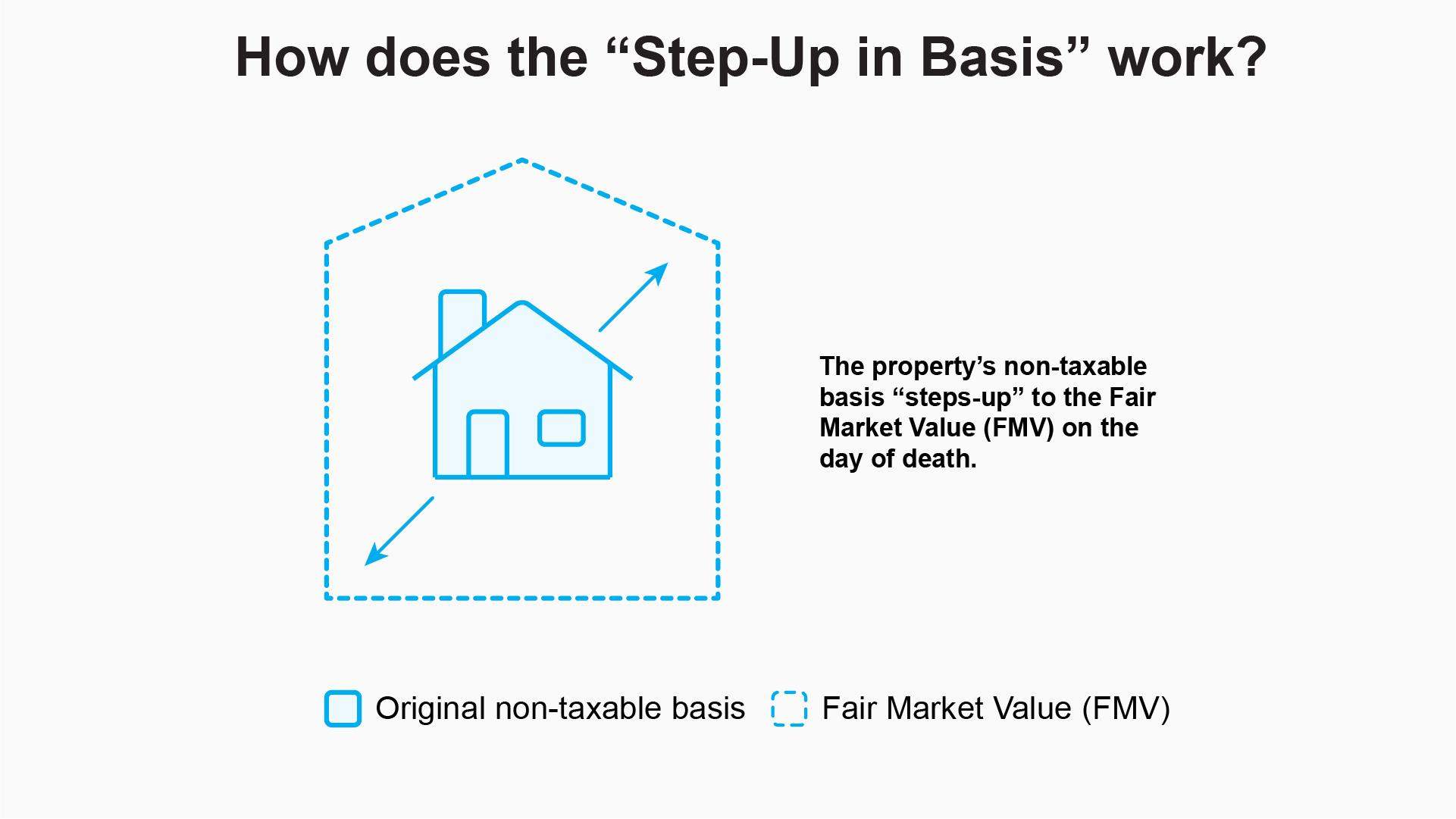

Through 2024, and per California state law, the estate may not be subject to the formal probate process if gross estate assets are more than $184,500 (including any California real estate). Estates smaller than $184,500 in total gross assets and with real property at most $61,500 and located in California may qualify for the more expedited probate process.

In these cases, a Small Estate Affidavit may be used in California to distribute assets and change title.Still, more complicated estates may require specialized trusts to reduce estate tax, be tax efficient, maintain desired outcomes, or avoid beneficiaries from disqualification from government assistance programs. Estate planning techniques will use a trust drafted by a licensed attorney and supersede the need to go through the probate process. A trust and detailed estate plan can streamline distributions for beneficiaries, reduce tax, eliminate court fees, reduce other complications, and avoid unnecessary frustration.