Home » Advice-Only™ Frequently Asked Questions

These Advice Only Frequently Asked Questions (FAQs) explain costs, process, privacy, and our methodology. Our fiduciary structure keeps advice objective and transparent. We detail out the Advice-Only™ methodology — from structural separation and fiduciary standards to pricing and course participation. Learn how our approach differs from fee-based, fee-only, flat-fee, and fee-for-service advice, and why it’s designed to preserve objectivity and transparency in every plan by keeping advice separate from all forms of sales.

Explore the Advice Only Frequently Asked Questions below or contact us if you don’t see your question.

Advice-Only™ financial planning is a structurally defined engagement designed to separate

advice from implementation, sales, and asset-gathering incentives. Within the engagement, the advisor

does not manage assets, execute transactions, sell products, or receive any compensation tied to implementation.

The result is a Zero-Influence Environment™ where recommendations can be formed without downstream incentives.

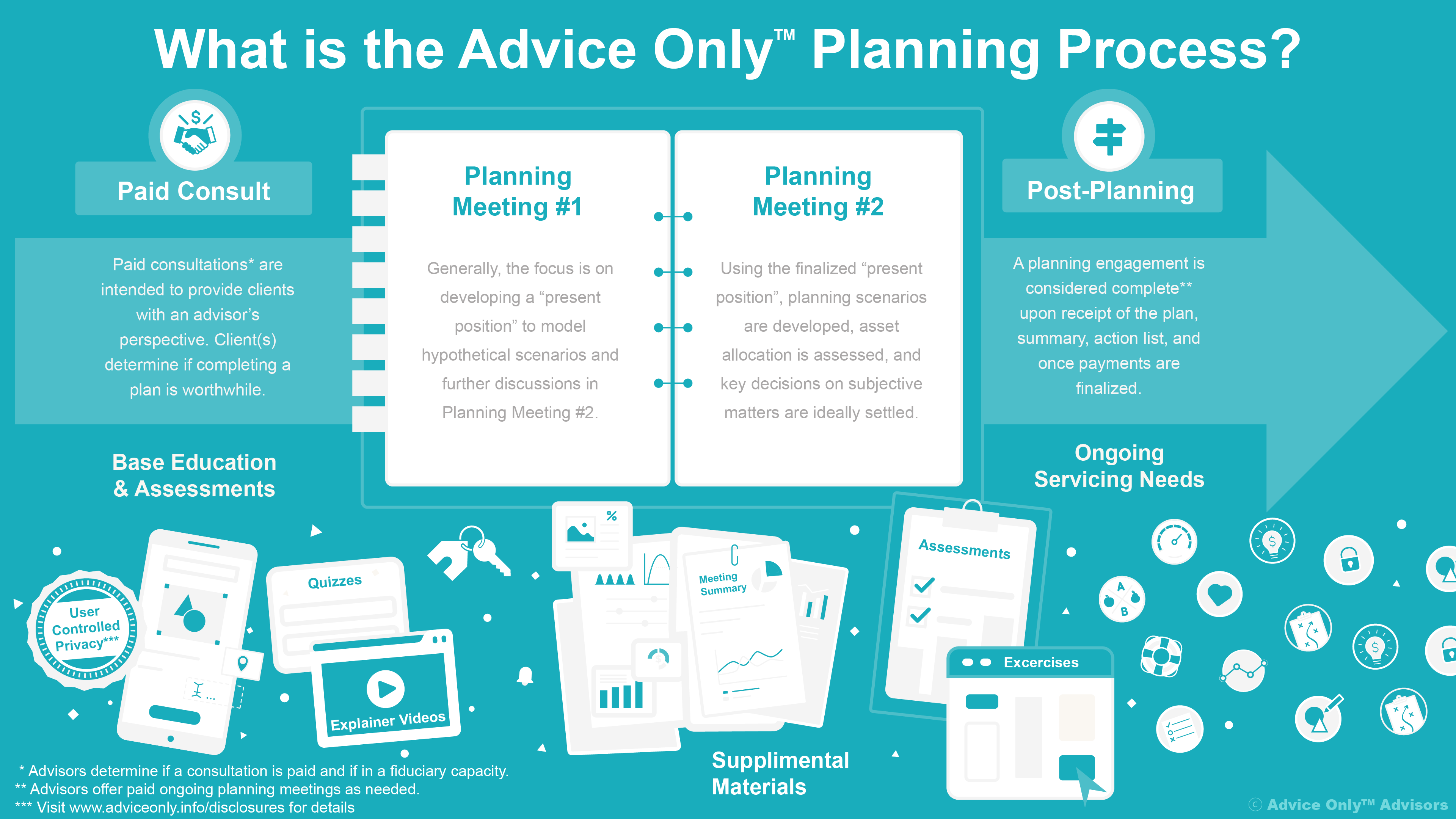

Every engagement begins with a paid, written advisory agreement. The first meeting is a true fiduciary session

(not a qualification screening) where you receive actionable guidance, and we confirm the planning-only structure.

We establish your Present Position—the factual, math-based baseline of your current finances—and collect the inputs

used to build consistent scenarios and evaluate tradeoffs.

We develop aligned planning scenarios, pressure-test assumptions, and produce clear recommendations with documented

rationale, alternatives, and tradeoffs—so you can act independently.

The Advice-Only™ engagement ends when you receive your Planning Memo, scenario outputs, and action roadmap.

This stopping point is the Engagement Completion Boundary: no implementation, execution, monitoring, or asset management

occurs inside the Advice-Only™ engagement.

After the engagement concludes, you choose how to implement—on your own or with any provider you independently select.

Advice-Only™ does not require you to implement with anyone connected to the planning engagement.

Some advisors may offer other services elsewhere in their practice, but those services are structurally outside the Advice-Only™

engagement. What matters is what is permitted inside the engagement: planning-only work, client-paid fees, and no implementation-linked incentives.

Our instructors are practicing financial advisors who publish original educational content on the

Advice-Only™ platform. Learners may choose to work with any advisor — including the instructor —

but no advisor is positioned as a default or preferred provider.

Some clients value continuity between education and planning and may independently choose to

engage the same professional who authored a course. When that happens, it occurs through a

separate, client-initiated Advice-Only™ engagement — not as a continuation of the class.

The platform never routes, steers, or incentivizes clients toward any specific advisor.

Costs are transparent and set by each advisor-instructor. Education may be free or paid per course, and advisors publish their fees for all plans and consultations.

No. Advice-Only™ does not screen clients by net worth or investable assets. Participation depends on willingness to engage in the planning process and complete agreed steps—not portfolio size or what you have.

Yes. The framework is designed for public use by consumers, educators, and advisors seeking a transparent, deconflicted planning model. Advisors who adopt it are expected to meet ethical and licensing standards consistent with fiduciary practice.

Clients provide accurate information and actively participate in discovery and goal-setting. Collaboration and transparency help ensure personalized, data-driven advice.

We believe privacy is a part of our fiduciary duty. As such:

We DO NOT sell or share client information.

Information is only disclosed when you direct us or when legally required.

Our firm does not participate in affiliate programs or accept referral benefits.

All records are stored securely

Our methodology provides a planning experience that reduces conflicts of interest. It works by strictly separating financial advice from the sale of any products and by never requiring asset minimums to work with us.

Our advisors receive no economic benefit from referrals. During plan development, they are prohibited from accepting reciprocal referrals or asset-based compensation. However, if a referral is truly in a client’s best interest, we will first disclose any potential conflict of interest in writing and get your written acknowledgment before proceeding.

No, we do not generally offer free consultations. We believe paid consultations provide more value by offering immediate, actionable advice under a formal advisory agreement. This avoids the sales pressure common in free introductory meetings.

An Advice-Only™ advisor is a financial professional who agrees to deliver planning inside an Advice-Only™ engagement—a structurally defined, planning-only environment designed to prevent implementation incentives from influencing recommendations.

During an Advice-Only™ engagement, clients can expect:

Planning-only scope (no product sales, no asset management, no execution inside the engagement)

Client-paid fees only (no commissions, AUM billing, or referral incentives tied to implementation)

Clear process + documented reasoning (rationale, assumptions, alternatives, and tradeoffs)

These commitments are summarized in our “Our Truths”—the principles that keep the Advice-Only™ environment objective and transparent.

Clients may learn from advisors through courses and educational content on our platform, and they may independently choose to engage any advisor for a separate Advice-Only™ planning agreement. The platform does not route, steer, or position any advisor as a default provider.

To learn more, visit the About Us page and look for the section “Our Truths.”

For a full Advice-Only™ planning engagement, yes — because objectivity depends on completing the structurally defined process.

However, a client always retains the right to end or decline an Advice-Only™ engagement at any time. If a client independently chooses to pursue implementation, product services, or asset management outside the Advice-Only™ framework, that activity must occur outside the Advice-Only™ engagement and without any advisor solicitation or expectation.

Any such decision must be:

Client-initiated

Documented in writing

Structurally separate from the Advice-Only™ engagement

Once a client exits the Advice-Only™ engagement, the Methodology no longer governs what happens next — and no Advice-Only™ services may continue unless a new, planning-only engagement is created.

Advice-Only™ engagements begin with a paid fiduciary consultation conducted under a written advisory agreement. That session is not a sales call or qualification screen — it is a real planning meeting that delivers actionable advice and establishes the scope of the engagement.

Additional meetings, if needed, are governed by:

the agreed engagement scope,

the advisor’s published availability, and

the client’s planning needs.

All Advice-Only™ meetings — including follow-ups — remain subject to the same structural rules:

no sales, no asset gathering, no product solicitation, and no compensation tied to implementation.

Clients may choose to schedule further planning sessions as needed, but no consultation may be used to screen, qualify, or funnel clients toward future implementation or AUM services.

Advice-Only™ is a standardized process that keeps advice structurally separate from new implementation and compensation tied to assets or products. Fee-only, flat-fee, fee-for-service, fee-based, or AUM models may still blend planning with implementation revenue. This can reintroduce incentives the framework is specifically designed to avoid.

Begin by exploring the educational materials and courses that match your needs.

If you later decide to engage an advisor for personal planning, you may independently choose any Advice-Only™ advisor who meets your preferences and availability.

No advisor is assigned, routed, or preferred by the platform. Any planning engagement occurs only through a separate, client-initiated Advice-Only™ agreement.

Advice-Only™ advisors determine their pricing for stand-alone planning. An advisor’s level of experience and/or specialty may determine their pricing.

No. While many Advice-Only™ advisors have professional experience implementing financial strategies, advisors share that experience only for objective advice. When developing a plan under the methodology, advisors provide stand-alone planning and education—not investment management or product sales. If implementation is later desired independently by the client, they may choose any provider once the plan is complete. Advisors make recommendations solely in the client’s interest and without any compensation to the advisor beyond client invoices.

Clients may choose any professional or firm to implement their plan. However, under the Advice-Only™ Methodology, no solicitation, referral, or implementation discussion is permitted within the planning engagement.

The Advice-Only™ engagement ends at the Engagement Completion Boundary — the point at which all agreed planning questions have been answered and recommendations delivered. Only after that boundary may implementation-related discussions occur at the client’s request.

A Post-Engagement Implementation Discussion is defined as any meeting in which:

is proposed, discussed, or arranged.

Such discussions:

An Advice-Only™ advisor may not act as both planner and implementation provider within the same engagement, and may not imply or suggest that implementation with the advisor is expected.

Clarification: This lifecycle step was formerly referred to as a “Solicitor Meeting.” It has been renamed Post-Engagement Implementation Discussion to more precisely reflect its optional, client-directed nature and its structural separation from the Advice-Only™ planning engagement.

For avoidance of doubt, solicitation includes all forms of value — not just money — including referral exchanges, reciprocal favors, lead sharing, or any non-monetary benefit that could influence advice.

By law, licensed financial professionals must provide access and update details of their practice and the firms with which they are associated. Information on investment advisors and their firm’s registered representatives is available at adviserinfo.sec.gov.

Most everything we do centers around client convenience. However, our general policy allows the advisor discretion to determine if in-person meetings are applicable. In-person meetings may be included in the prices for some advisors. Others may add a surcharge for this service, while some advisors may only have a virtual office. Ask your advisor how they work or look for the indication on their profile.

Advice Only™ Financial Advisors is headquartered in Corte Madera, California. Clients nationwide may work with licensed Advisor-Instructors through virtual engagements, subject to state and SEC licensing.

Advice-Only™ planning is designed to evaluate options, tradeoffs, and long-term consequences before financial decisions become constrained by emergencies, deadlines, or irreversible events. In some cases, clients may arrive in crisis. While we will do our best to clarify what options remain, crises often fall outside the scope of forward-looking planning because key decisions may already have been forced.

In those situations, the planning engagement may conclude sooner than usual if continued advisory work would not provide meaningful value. When appropriate, we will recommend other forms of professional or public assistance — such as tax professionals, legal counsel, healthcare providers, or social support programs — that are better suited to address urgent or non-planning issues.

This ensures clients only pay for planning when it is genuinely useful, and prevents advice from being extended beyond its proper professional scope.

We properly cite, acknowledge, compensate, and, when appropriate, contact and request permission from the artists, photographers, authors, and data providers used in our courses.

If we have made a mistake or you have a suggestion or concern, please contact us so we can evaluate and, if appropriate, remove or change a reference to ensure accuracy and due credit.

Please visit the Contact Us page on our website if you have questions, comments, suggestions, or concerns. If appropriate, we’ll do our best to respond within 72 hours.

Have additional Advice-Only™ Frequently Asked Questions? Contact us to learn more.