Fulfill retirement planning competence with 2025 Retirement Planning Basics, an exciting and comprehensive course from Advice Only®, and available from the Google Play and Apple stores. This self-paced course, enriched with original written and video-based content, is designed to make your learning experience enjoyable and relatable with amusing anecdotes. Taking approximately 6 hours to complete, this course includes informative assessments, exercises, explainer videos and quizzes to ensure a thorough understanding of the material.

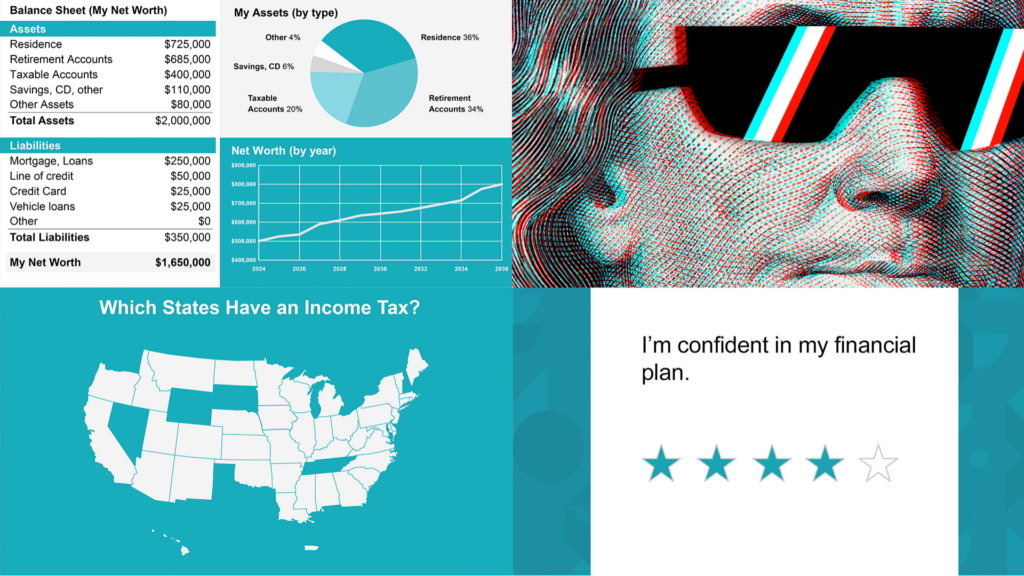

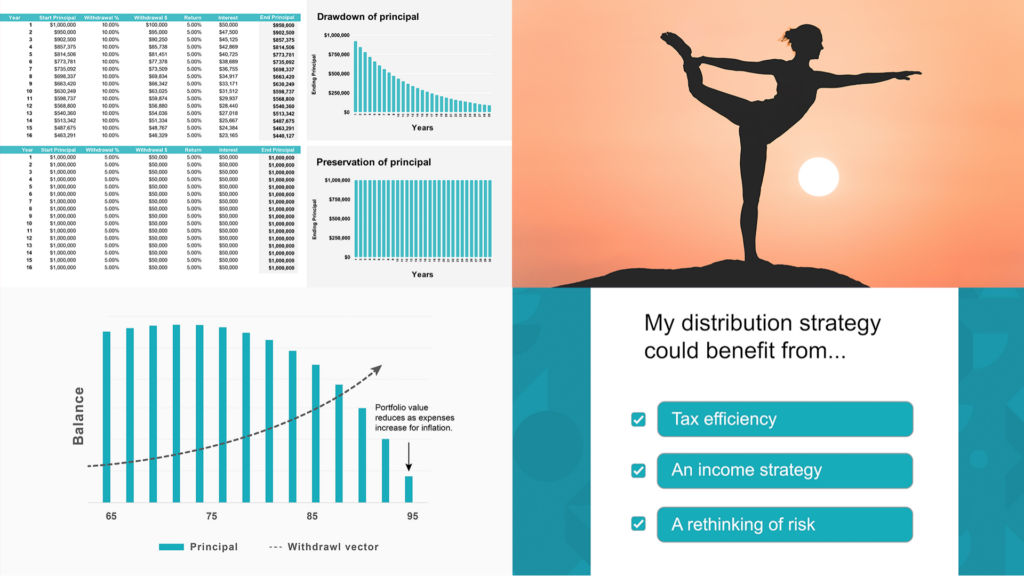

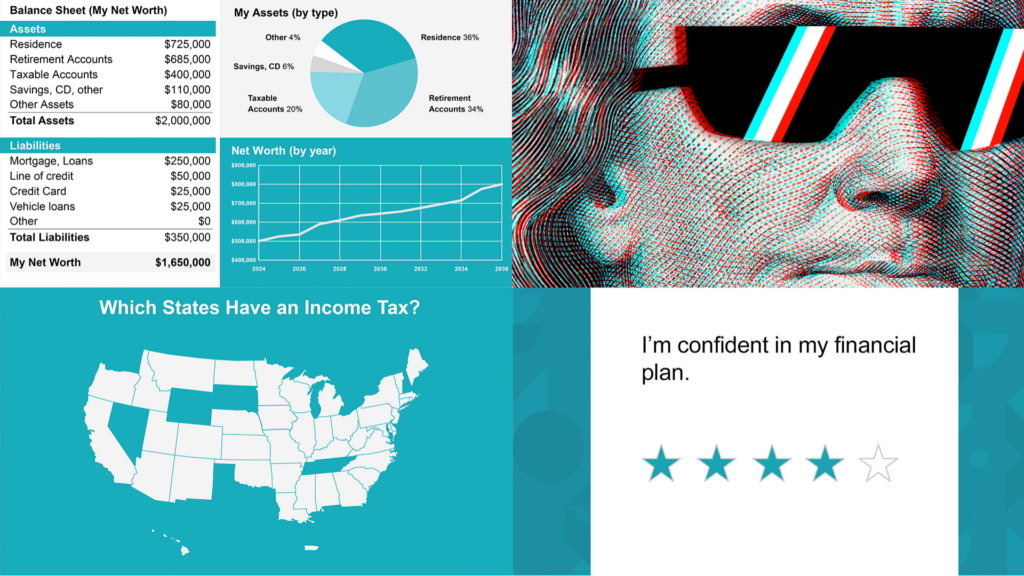

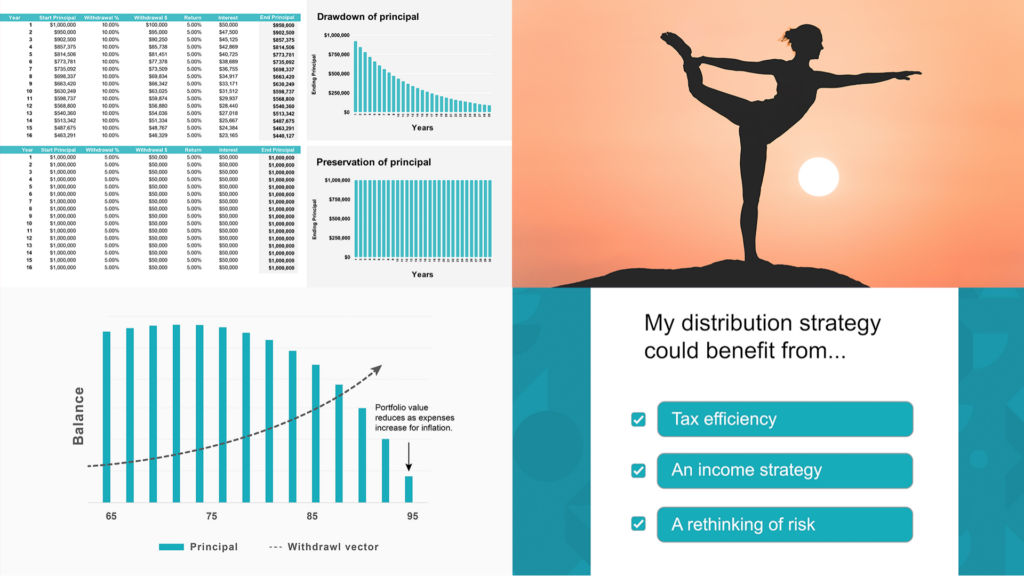

Particularly for retirees, cash flow and net worth statements are the primary documents for evaluating a financial plan’s overall health and long-term sustainability. These documents show how future income, expenses, taxes, and total portfolio assets interact to create a transparent “vector” to achieving retirement goals.

Particularly for retirees, cash flow and net worth statements are the primary documents for evaluating a financial plan’s overall health and long-term sustainability. These documents show how future income, expenses, taxes, and total portfolio assets interact to create a transparent “vector” to achieving retirement goals.

Made with 🤍 by AdviceOnly.info