In Advice-Only planning, we use a fee structure firewall to separate planning fees from all implementation incentives, so structure—not personality—carries the weight of objectivity.

The Fee Structure Firewall™ is our answer to this problem. Rather than relying on promises of “objectivity,” the Fee Structure Firewall™ creates a hard, structural barrier between the advice a client receives and any compensation that could be earned from implementation. It is one of the central safeguards used in the Advice-Only™ Philosophy, the Advice-Only 40-Point Framework™, and the Advice-Only™ Standards of Practice.

Defining the Fee Structure Firewall™

In plain language, the Fee Structure Firewall™ is a rule: the advisor’s compensation for planning cannot depend on what, where, or how the client implements.

As defined in the

Advice-Only™ Glossary, the Fee Structure Firewall™:

- Prohibits implementation-based compensation such as commissions, load sharing, trails, or revenue sharing tied to specific products when going through the Advice-Only planning process.

- Blocks asset-gathering incentives where asset-based (AUM) fees or platform payouts reward moving or retaining assets in particular accounts.

- Removes referral kickbacks and “soft-dollar” benefits such as cash, marketing support, or “preferred” status for steering business.

- Rejects non-monetary referral currency (warm introductions, reciprocal referrals, co-marketing) that function as compensation in everything but name.

Under the Fee Structure Firewall™, planning is billed as planning, not as a loss-leader for products or a feeder system for asset management or other forms of implementation.

The Problem It Solves: Fee Structures as Invisible Steering Mechanisms

Most financial-planning models still live inside what the Advice-Only™ Glossary calls the Two Masters Problem: the advisor is asked to serve the client and the compensation model at the same time.

Even when advisors are ethical and well-intentioned, fee structures can quietly steer behavior:

- “Free” planning that exists mainly to funnel assets onto a particular platform.

- AUM fees that reward gathering and retaining assets above all other considerations.

- Referral networks built on reciprocity instead of pure fit for the client.

- Subtle pressure to favor strategies that protect revenue over strategies that reduce it.

These forces are often invisible to clients and sometimes even to advisors themselves.

The Fee Structure Firewall™ makes those forces structurally ineligible to influence the planning work.

How the Fee Structure Firewall Protects Clients

The Fee Structure Firewall™ is not a slogan; it is a set of operational rules applied throughout the Advice-Only 40-Point Framework™.

In practice, it means:

- Planning-only compensation. The advisor is paid a stated fee for analysis, recommendations, and education—not for selling, transferring, or managing assets.

- No quota, grid, or platform bias. The advisor’s pay does not change based on which custodian, product, or provider the client selects.

- No back-end economics. The advisor does not receive marketing support, trips, “preferred status,” or other benefits in exchange for steering implementation.

- Clear separation of roles. If a client chooses to implement, any conversations about specific providers occur after the plan is delivered and not in exchange for compensation or reciprocal favors.

The result is a planning environment aligned with the Advice-Only™ philosophy where objectivity is treated as a design choice, not a personality trait.

What the Fee Structure Firewall™ Allows — and What It Prohibits

The Fee Structure Firewall™ is not a refusal to acknowledge client-led implementation. It is a refusal to let implementation economics drive the planning work itself. A helpful way to think about it:

What the Fee Structure Firewall™ Prohibits when planning

- Commissions or payouts tied to specific products, share classes, or carriers.

- AUM fees that create pressure to gather or retain assets in a particular account or platform.

- Any compensation—monetary or non-monetary—for referring clients to specific providers.

- Bundling “free planning” with an expectation that implementation must occur with the same firm.

What the Fee Structure Firewall™ Allows

- Implementation questions and education. Clients may ask general questions about products or platforms, and advisors may provide neutral education tied to the client’s plan. All implementation decisions, evaluations, and provider selections occur entirely outside the Advice-Only™ engagement.

- Client-directed implementation. Once planning is complete clients may choose any provider, platform, or firm to carry out the plan once planning is complete. The advisor’s fee does not change based on that choice.

- Separate, client-initiated conversations. If the client wants ongoing help with implementation, that conversation happens outside the Advice-Only™ planning engagement and remains free of referral or product incentives.

In other words, the Fee Structure Firewall™ does not isolate clients. It protects their choices by ensuring the advisor’s economic interests are not riding on how those choices are made.

How the Fee Structure Firewall™ Relates to Structural Separation

The Fee Structure Firewall™ is one of the tools used to implement Structural Separation: the formal divide between financial planning and all forms of implementation.

Structural Separation answers the question, “Where does planning stop and implementation begin?”

The Fee Structure Firewall™ answers the question, “What happens to the advisor’s incentives on each side of that line?”

- Structural Separation defines distinct planning and implementation phases, so the advice is not delivered inside a sales pipeline.

- The Fee Structure Firewall™ ensures that, even when implementation is discussed later at the client’s request, the advisor’s compensation remains independent from what is bought, where assets are held, or which providers are chosen.

Together, they support the Advice-Only™ goal of creating a “cleanroom for decisions”—a space where clients do not have to guess whether a recommendation is being shaped by hidden incentives.

What the Fee Structure Firewall™ Means for Clients and Advisors

For Clients

- Clarity. You can see what you are paying for and why. Planning fees are stated up front and not buried in products.

- Choice. You can implement with any provider you independently decide.

- Confidence. You can focus on tradeoffs, tax impact, and long-term fit instead of second-guessing the planner’s motives.

For Advisors

- Alignment. Your income is tied to the quality of your analysis and communication, not the volume of product you move.

- Freedom. You are free to recommend what you would choose for yourself or a family member, without worrying about payouts or grids.

- Professional identity. You are hired as a planner and educator, not as a salesperson with “advice” attached.

Advisors who adopt the Fee Structure Firewall™ are not asked to limit their expertise. They are asked to submit their work to structure, so that good intentions are backed by design.

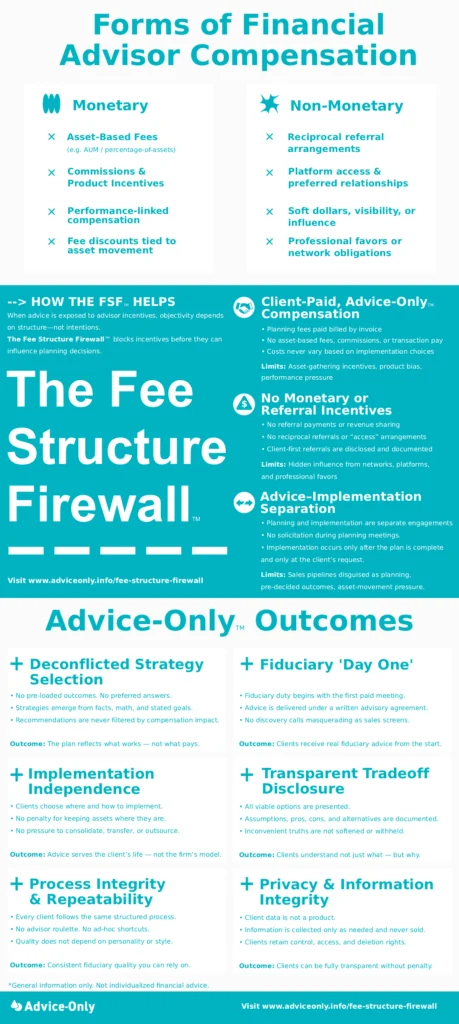

Visualizing the Fee Structure Firewall™ in Advice-Only Financial Planning

The diagram below illustrates how the Fee Structure Firewall™ separates planning fees from both monetary and non-monetary implementation incentives, preserving objective advice.

Explore the Advice-Only™ Standards Behind the Fee Structure Firewall™

The Fee Structure Firewall™ is one of several structural safeguards that make the Advice-Only™ Methodology a deconflicted, client-first approach to planning. To see how it fits into the larger system, explore:

- The Advice-Only™ Philosophy

- Advice-Only 40-Point Framework™

- Advice-Only™ Standards of Practice

- Advice-Only™ Glossary

Together, these resources show how the Fee Structure Firewall™ helps build a planning environment where clients hold the keys, advisors are paid for advice—not sales—and every recommendation is grounded in a deconflicted framework.

The Fee Structure Firewall™ ensures deconflicted compensation, while the Engagement Completion Boundary ensures deconflicted implementation. Together, they preserve structural fiduciary neutrality throughout the planning engagement.