Developing an effective budget is one of the most avoided aspects of the financial planning process. However, a realistic sense of one’s budget is essential since it is only possible to determine the sustainability of a financial plan with one. Budgeting is tied to cash flow, so not having a reasonably accurate sense of expenses renders financial planning documents unreliable when making consequential financial decisions.

The best way to build a budget

It’s true; technology allows anyone to import or link accounts to free tools making budget development a less painful process. Transactions are manually or automatically uploaded, while algorithms create beautiful spreadsheets for detailed analysis. Of course, privacy considerations generally go hand in hand with these solutions.

Before agreeing to the terms and conditions, consider the advantages of a similar level of accuracy and greater control over your data with just a little due diligence.

Aside from the privacy risks, fancy tools can be a distraction. The result can be lost focus on what’s actually needed. You may ultimately find you’re better off just downloading the transactions as a .csv or .txt file – then copy and paste the data into a spreadsheet.

Download the transactions

Data-oriented file types are readily available from all financial institutions. These files are compatible with your preferred spreadsheet manager (i.e., Google Sheets, Excell, Open Office). Once downloaded, import the file into the spreadsheet program and “copy and paste” the transactions to a new spreadsheet. The whole process should be complete in just a few seconds. The hard part is done – and now the real fun begins.

Recommendation: Rebuilding the Retirement Planning Buckets

Organize the transactions

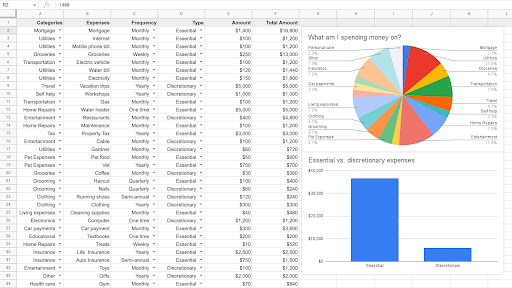

Once values are in the spreadsheet, we recommend categorizing expenses individually – so it’s easy to sort them later. If more categories are required, you can add them using this method. If you need help getting started, use our sample budget.

Select the frequency

Next, indicate the frequency as monthly, quarterly, semi-annually, annually, or one-time.

We find individuals approaching retirement often have planned one-time expenses. Common examples include house improvements or repairs. Label them as “one-time.”

We find it helpful for clients to separate essential expenses from discretionary. That’s because if the financial plan ever requires an evaluation of spending to meet goals, separating expense types will help with the analysis. No matter what, it’s fruitful to know where the “wiggle room” is, even if trimming back expenses is not ultimately required.

Hopefully, it’s clear that developing an effective system for budgeting is not only essential but also not time-consuming or complicated. Very quickly, one should be able to get expenses identified, organized in a privacy-centric way, and with little to no ongoing hassle. Once a system is up and running, the exercise should generally not take more than 30 minutes to complete. The need to revisit one’s budget can vary. We say any time there is a need to evaluate cash flow projections; it’s an excellent time to check in on the budget and determine if spending has changed substantially.

Being overly strict with budgeting may be less fruitful than one might expect. Individuals shouldn’t feel bad about having discretionary purchases.

What’s essential?

Determining discretionary expenses is part of a healthy and realistic financial plan. The peace of mind goes a long way to enjoying discretionary expenses fully and later determining if they are worth keeping. Avoid making the exercise more complicated than needed or tied to anxiety. Remember, it’s not about getting expenses to some magic number; it’s about ensuring financial planning projections are sustainable and satisfactory for all interested parties. Expenses will always be a moving target; you will only ever get it reasonably close, and breaking the budget will occur. Plan on it.

Financial professionals won’t judge most expenses one has. We’re much more interested in and concerned with helping clients determine if the spending “vector” is sustainable. Or if there are fundamental changes to spending required to make the plan more sustainable (i.e., downsizing, moving to a new location, saving more, making more, or spending less). Most of the time, this is easier said than done.

Identifying illusive expenses

Control and awareness are the benefits of a more hands-on approach to budgeting versus automated solutions. Once information is categorized, you may identify incorrect, outdated, or missing expenses. When this happens, keep going! Next, decide if the specific expense can benefit from further research.

Other documents helpful in identifying expenses:

- Mortgage & property tax statements

- Insurance declaration page

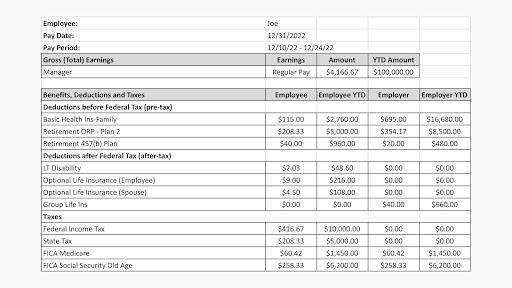

- Recent pay stub (taxes, retirement accounts, Health Savings Accounts, disability contributions, and health insurance information)

The value of a professional’s perspective

A good advisor will complete a lot of plans, and what tends to happen is that people in a geographic area fall into one of a small number of “expense brackets.”

We’re all shopping at the same places and buying the same stuff, so distinct and identifiable patterns in spending are likely identifiable. When working with many people, an advisor aggregates this knowledge and will likely be able to translate this to an “opinion” of if your expenses appear “believable” and are in line with other clients with similar profiles.

Why be real with budget?

A sustainable budget will account for both essential and discretionary expenses. A sustainable budget will adjust with inflation over time and, when paired with a cash flow analysis, project expenses against income and portfolio withdrawals. A realistic financial plan depends upon these variables for accuracy. The cash flow projection will provide a year-by-year snapshot and help identify whether the plan can maintain a desired standard of living and not run out of money before mortality.

If one is behind in achieving financial goals, it may make sense to look back at those identified discretionary expenses and see where there can be improvements. Going through the exercise outlined earlier, you likely already know where “wiggle room” can be found (if any). As noted earlier, you now have a realistic way to identify potential improvement.

I do not recommend assuming that spending can be reduced or eliminated. It may only happen if there is a concerted effort to curb spending overall. Sometimes change is required to achieve sustainability, and tough decisions may need to be made.

Editor’s note: This blog offers informal investment and financial planning advice. We know nothing about your unique financial situation. The buying and selling of any financial product or security should only be considered in context. If appropriate, seek the counsel of experienced, ideally objective, financial, tax, or estate planning professionals. Past performance is not indicative of future performance.