Planning a sustainable withdrawal strategy is one of the most overlooked areas of financial planning. A clear and coordinated withdrawal strategy is crucial because it will ultimately determine how an individual will create sustainable income throughout retirement.

Successfully navigating retirement

Sequence risk is the risk in the timing of withdrawals from a market portfolio occurring in inopportune market conditions. Incurring negative returns associated with the sequence of returns risk (also called the order of returns) is generally most damaging in the early retirement years. This is because if negative returns occur (and money still needs to come out), then locked-in losses (like returns) compound and can significantly increase the probability of depleting a portfolio before mortality. This phenomenon is still evident in later years, and one should always attempt to avoid locked-in losses. However, aggressively managing sequence risk in the early retirement years is usually more important. Often the predicament this poses is that the early retirement years tend to be the time when individuals want to spend their money.

[image]

Managing sequence risk is all about preparing for the storm before it comes, not when it comes. If you are unfamiliar with sequence risk, I encourage you to watch our video series. I see at least four primary ways to successfully navigate sequence risk.

Spend less.

Easier said than done. If we were in a meeting and I offered this suggestion, I’d expect the client to throw me out of the virtual room. Losses hurt. What can be done to mitigate a loss and allow a recovery?

Hold cash.

Bummer, yes, but I always say, “The price of liquidity is the cost to inflation.” The silver lining is that as interest rates go up, holding cash will hurt less and less.

Buy an annuity (or pension).

I don’t know too many people eager to run out and buy an annuity. (If you hate the concept, please kindly make your way to the next section). However, before you go, I don’t know many people who hate their pension or social security. But let’s be honest, a pension and a Single Premium Immediate Annuity (SPIA) are very much the same.

Here’s the deal. Not all annuities are equal. An annuity pension from a government job (or social security) utilizes a much different formula based on things such as tenure, which tend to be more favorable. Furthermore, these programs are far more likely to offer a COLA (or cost of living adjustment) by default. COLAs, I find, are often a game-changer in many retirement plans offering long-term stability to offset inflation-adjusted expenses. At the same time, annuities from XYZ insurance company are primarily based on current interest rates, and adding a COLA can often result in “sticker shock.”

In theory, SPIAs being based on current interest rates could be a good or bad decision; I suppose it all depends on the interest rate and, ultimately, the payout versus other investable assets. Recently, interest rates have been meager, making the income lackluster. But as interest rates begin to climb (or shoot up), the strategy becomes more and more viable. That’s because the money put into an income annuity (such as SPIA) offers buoyancy to the rest of the financial plan. No longer is the individual required to rely solely on market returns to make ends meet. To boot, if you feel you have longevity, you may be able to benefit from capturing “mortality credits” – something only attributable to insurance-based annuity products.

Just hold bonds.

I’m less inclined nowadays to rely on this “fire and forget” strategy for a large portion of someone’s “safe” wealth because of the recent volatility we’ve seen in the bond market. Historically, advisors and clients assumed bonds would offer insulation against losses in a downturn. However, we’ve seen several instances where the “wrong kind” of bonds are hit while stocks get hit even harder. While the strategy remains sound to hold bonds for insulation, I believe rethinking what type of bonds to hold (not just any bond) is prudent.

Additionally, I think it’s vital to understand bonds do come with risk. You may not know, but there are riskier types of bonds, such as international bonds and so-called “junk” (or high-yield) bonds. It’s essential not to get too greedy with yield. At least so much that the core strategy behind the bonds in the first place becomes mitigated.

[image]

Buy Real Estate.

I’m always impressed by this one, but when it’s the right personality fit. We all have a love affair with real estate. It’s almost human nature. But it’s important to understand not everyone should consider themselves the right personality to become a real estate tycoon.

Furthermore, the potential tycoon should clearly understand what I call their “after everything return.” You should care about what will go into YOUR pocket after ALL expenses are considered. At the end of the day, how does the property’s net net net return compare to other less time-intensive offerings?

You want a post-tax account

Not enough clients that I meet have substantial brokerage accounts. The ones that do, it’s often by happenstance.

Common ways include:

- A downsize where excess proceeds from the sale go into a post-tax brokerage account.

- An accumulation of employer stock (that may or may not have been diversified)

- An inheritance of post-tax money

Brokerage accounts are generally not “retirement accounts,” but are still excellent vehicles for retirement income. That’s because many of the most tax-beneficial financial instruments enjoy being in post-tax brokerage accounts—for example, municipal bonds and qualified dividend-paying stock.

I should note that some will eventually build a post-tax account as Required Minimum Distributions (RMDs) come out. That is excess money required to be withdrawn from deferred accounts (such as IRAs, 401(k)s, etc.) and now needs a home. Enter the post-tax brokerage account. Unfortunately, these usually come far too late in the retirement timeline to accumulate to a sizable level – and be deployed as an income “engine” strategy.

When it comes to brokerage accounts, size matters. It’s hard to anticipate much money from a post-tax portfolio with a $100,000 balance. The post-tax retirement “engine” relies on a “preservation of principal” strategy where the primary account balance holds, and income generates annually. While there is more to it when considering taxes and “tax loss harvesting,” that’s the basic concept.

[image]

When large sums of income from the brokerage account are withdrawn at unsustainable levels, the account can be depleted quickly, and the income strategy no longer becomes viable. But as mentioned earlier, some restorative forces can help “juice up” the brokerage account (i.e., inheritance, downsize, or RMDs)

A hybrid solution to money management

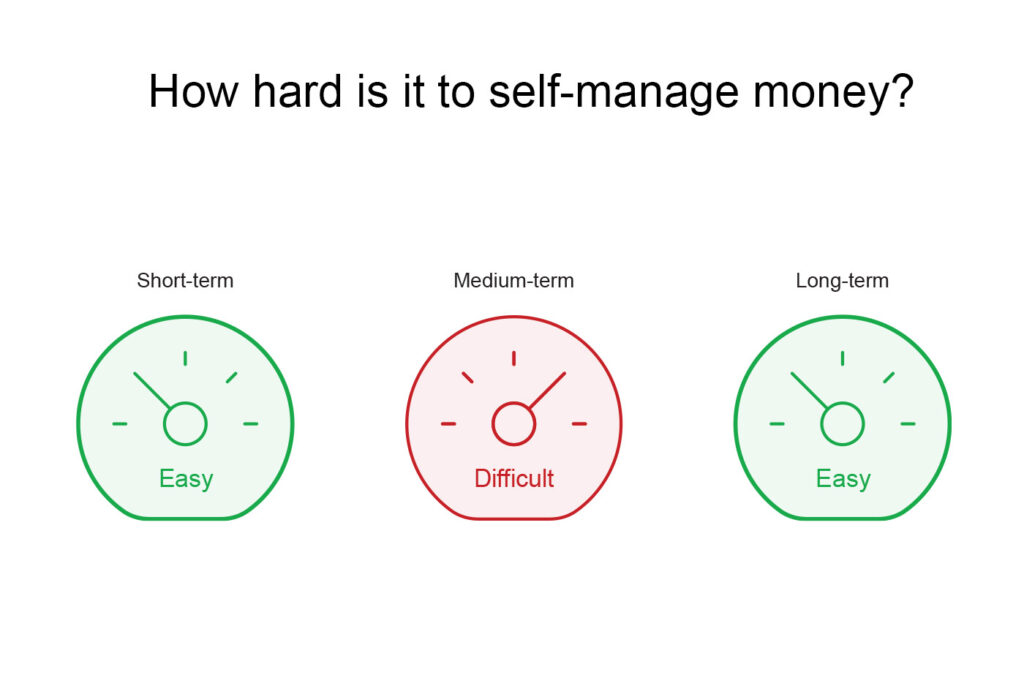

Not everyone should manage their own money, but almost everyone can manage certain aspects of their own money. Guess what? You’re already doing it. When discussing money, I usually refer to them in short, medium, and long-term timelines. If you are unfamiliar, read this article. I’ve always said you want to not think of your money as one big giant chunk but instead attribute each dollar to its anticipated usage point.

Short-term money is easy to self-manage.

Your checking account and budget are not generally something anyone will do for you. Lots of tools and resources exist to help tighten up your technique. Check that on off, thanks to technology and automation.

Long-term money can be easy to self-manage.

I’ll skip ahead and discuss why long-term money (or money you know is 100% FOR A FACT) must be set aside and left unfettered under all conceivable scenarios for at least 10 years or more. This is your “go for it” money and your most significant offset to long-term inflation. Interestingly, there is not much of a compelling reason to pay anyone a 1% fee to manage this pot of money. That being for a mutual fund expense ratio or as an advisory fee. Ironically as one takes more risk and the timeline for money stretches out, management becomes more accessible and cheaper. It’s just how it is nowadays. You’re not trying to be tactical; you’re just trying to grow the balance to counteract inflation and have consciously committed to “hold the line” and absorb the inevitable losses as they occur.

However, there is a point where it’s just “worth it” to have someone do all the work. I think that amount is subjective for the individual, the family dynamic, and the stage of life. It doesn’t make much sense to Do-It-Yourself (DIY) into failure. Know who you are, and what you’ll do, so set a price for your time and convenience.

Time is on my side.

– Jerry Ragovoy (1963)

Is DIY right for me?

In most cases, it is deferred or tax-free money (401(k), traditional IRAs, Roth IRAs, etc.) It’s fair to assume that if you set up a well-diversified portfolio and “rebalance” quarterly, you’ll be just fine.

For long-term money, I genuinely do not believe there is compelling evidence of that. But I think it is much more about the minimum levels of “behavior control” and due diligence on an ongoing basis rather than some secret long-term management sauce. Like the short-term, long-term money is manageable, perhaps ideally with ongoing guidance. And in many cases, as this article implies – it might be a mathematical necessity for some plans to meet goals and remain sustainable over the long term. It may just simply cost too much to have the convenience.

There are ample online resources for an effective self-management of long-term money. Still, in my opinion (and as a subset of my advisory practice), one-to-one exposure to investing techniques from a professional can be a valuable solution. As I said, it may ultimately be the ONLY solution in many cases. My advice is that if this is of interest, start with some money in the long term, learn to or seek proper guidance on how to build a long-term portfolio, and get some “experience points” with self-management on that pot of money… see how it goes.

Remember, for the long-term; it’s less about tracking the return and more about whether you successfully stick to doing your due diligence tasks (i.e., rebalance and risk tolerance). However, I do not recommend that most people do that with large sums (to start) or with any medium-term money. Mistakes, like losses, hurt. It’s not as some tout “DIY ’til I die.”

Medium-term money is not as easy to self-manage.

I generally consider medium-term money to be anticipated (or conceivably) spent over the next 3-7 years. This money enjoys being in a post-tax and is often a “second line of defense” after cash. However, if you do not have a post-tax brokerage account, then your deferred money (IRAs and 401(k)s, etc.) may be at least partially considered medium-term. Determining the time difference can be difficult, so I’d recommend seeking a professional’s help to make that determination.

Medium-term money is challenging to manage because it is usually focuses on a very different strategy, usually income and preservation. It’s MUCH more about being tactical and not necessarily all about growth, growth, growth. I’m not saying all managers are successful at being “tactical.” However, having someone at the helm to make critical decisions with this money may be worthwhile. Furthermore, since medium-term money generally enjoys being “post-tax,” service-level features are nice. Examples include fund transferring and “tax loss harvesting.” It’s worth something to have that level of convenience on particular dollars.

Also, this is a generalized article, so some atypical situations may require adjusting what constitutes medium or long-term money and what type of account it’s in. But you get the idea.

Editor’s note: This blog offers informal investment and financial planning advice. We know nothing about your unique financial situation. The buying and selling of any financial product or security should only be considered in context. If appropriate, seek the counsel of experienced, ideally objective, financial, tax, or estate planning professionals. Past performance is not indicative of future performance.